Retirement, hey, many of us would like to retire. In order to retire, it's nice to have a pension so we have something to live on during retirement. Pensions today have become a major piece of property during a marital breakup, like a divorce. A big question arises - what happens to those vested pension rights that were accumulated during the marriage? Well, that brings us to this week's case, which involves a couple in New Jersey. In 1987, they got a divorce. He was a captain with the US Air Force, and the agreement under the divorce was that he would pay his wife 50%, one-half of his military pension at the time of his retirement. She had a 50% interest in that. Now, let's fast-forward over 20 years later and he retires. He looks at this and says, "You know, that's a lot of money that I'm gonna have to be paying her, and I think it's unfair that I pay 50% because I've stayed in the Air Force all of these years. I've gone through the ranks, I've gotten pay grade increases, and my pension is much higher than it would have ever been if I had not stayed in the Air Force after our divorce. Therefore, I don't think she is entitled to any of this." She, through her attorneys, argues, "No, in 1987 when we got divorced, it was agreed that at that time I would receive 50% of your pension on your retirement because I had contributed to your career in the military. I had been a stay-at-home wife and helped you through all these relocations and everything else to assist you in your career. I was going to receive 50% of your pension as a result of that, and bottom line, a deal...

Award-winning PDF software

Military retirement pay to ex-spouse who remarries Form: What You Should Know

If you do not already have a checking account that pays direct deposit, you may elect to transfer your pension benefits via Direct Deposit for a . , in increments of. , to your direct deposit account. This will allow any unclaimed benefits Frequently asked questions about Pension Benefits for Dependents or Spouses of Veterans In the absence of a court order granting direct payment on behalf of a former spouse, a service member may apply the same procedures for benefits for dependent children or dependents of a former spouse as are required for regular pension benefits without regard to when the individual became a service member. Frequently asked questions about Pension Benefits for Service Members who die in the line of duty A service member may qualify for his pension if he died while in duty. In the event that the service member dies outside the line of duty, the retired pay is reduced on a percentage of the total accumulated retired pay of the deceased member. Pension Benefits for Service Members who die outside the line of duty In the event that the veteran dies outside the line of duty, any of his pension benefit is reduced on a percentage of the accrued and unused retirement pay of the deceased veteran. If the disability is incurred while actively serving in the Armed Forces, an initial reduction of 50 percent of the retiree's service-related pension benefits may be awarded to the family of the deceased veteran, regardless of time served. Benefits of a Spouse's Disability Claim If a service member is diagnosed with a service-related disability, he can apply for a disability benefits claim. The benefits are then paid by the Department of Veterans Affairs to the service member's spouse through Disability Compensation, and the spouse is required to submit proof of service-connected disability as proof of disability. Disability Benefits for Service Members who die in the line of duty In the absence of a court order entitling the former spouse to a portion of a person's unused disability compensation entitlement, the retired pay paid to the former spouse under the Uniformed Services former spouses' protection and survivors of deceased service members' law provides no service-related entitlement.

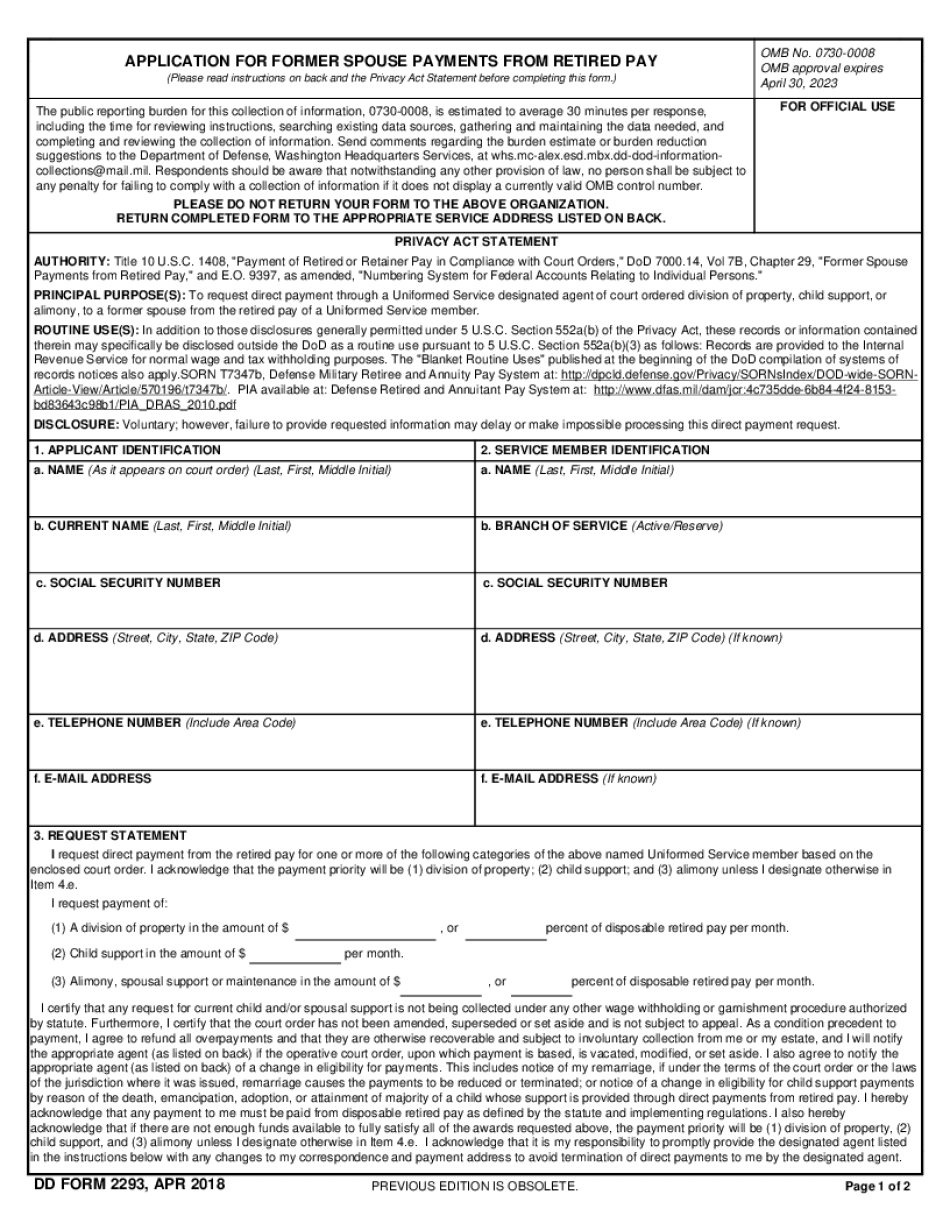

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 2293, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 2293 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 2293 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 2293 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Military retirement pay to ex-spouse who remarries