Military retirement and divorce can be an intimidating topic. However, I am here to provide you with some simple explanations. If you are going through a divorce, it is important to understand that all assets, including the car, house, accounts, investments, and belongings, will need to be divided between the parties involved. This also includes the military pension, which can be a more complex aspect of the divorce. So, how much of the military pension does the former spouse, in this case the wife, receive? And how much does the service member get to keep? To better understand this, let's visualize a timeline representing your military career. You started in the military on October 1st, 2008, and continued until December 1st, 2020. Now, let's consider your marital status. You got married in 2005 and remained married until October 30th, 2015, when you got divorced. According to Texas law, only the portion of the military pension accrued during the marriage is subject to division. The part before the marriage (2000-2005) and after the divorce (2015-2020) are considered separate property. So, the only part that will be divided is the portion that falls within the marriage timeline. The percentage that your ex-spouse will receive will be determined through negotiation or by court decision. In Texas, the standard division is typically 50%, but this can be negotiated to be lower or higher, up to 50%. To better understand the calculation of the amount, we can refer to a formula. This formula is used both during your divorce proceedings and in the military domestic relations order at the finalization of the divorce. Your attorney will gather specific information about your military service, marriage dates, monthly income, and the last 36 leave and earnings statements to calculate this formula as accurately as possible. By applying...

Award-winning PDF software

Military retirement divorce adultery Form: What You Should Know

Military Dependents' Dependency and Support Act of 1988, a spouse or former spouse of a member of the uniformed services is deemed to be the surviving spouse of that member. However, in certain circumstances, a surviving spouse may not obtain custody of or a share of the military dependent's estate under the Uniformed Services Support Act after a military member's death. See also the FAQ from the Defense Dependents' Benefits Program Dec 1, 2025 — Your military spouse or former spouse is entitled to access to military pension and benefits from the time of your divorce to the date of the de facto or same-sex marriage. The spouse must wait for five years from the date of the spouse or former spouse's separation to receive the benefits. You must take or provide a statement to the department indicating that the spouse or former spouse is entitled to these benefits as a result of his or her marriage to you. The statement must be submitted by a member of the military spouse's or former spouse's military dependent. The statement must be submitted annually in accordance with the requirement set forth in paragraph (b) of this section and must indicate the status of each spouse, whether he or she has access to any post-discharge education or training. See also the FAQ from the Defense Dependents' Benefits Program Dec 28, 2036 — Your former spouse or former common-law partner is eligible for part of your military pension benefits and for one-half of each portion of your pension paid to the spouse or former spouse. The spouse or former spouse must wait for five years from the date of separation to receive the benefits. The military member's entitlement period depends upon the number of dependents (other than a spouse) listed on the Form W-2 that was prepared for him or her. If a spouse or former spouse's dependent died at or after the separation, the dependent was entitled to receive an amount that was based upon a percentage of the military member's deceased veteran's pension. Under the Military Dependents' Dependency and Support Act of 1988, a spouse or former spouse of a member of the uniformed services is deemed to be the surviving spouse of that member. However, in certain circumstances, a surviving spouse may not obtain custody of or a share of the military dependent's estate under the Uniformed Services Support Act after a military member's death. See also the FAQ from the Military Dependents' Benefits Program.

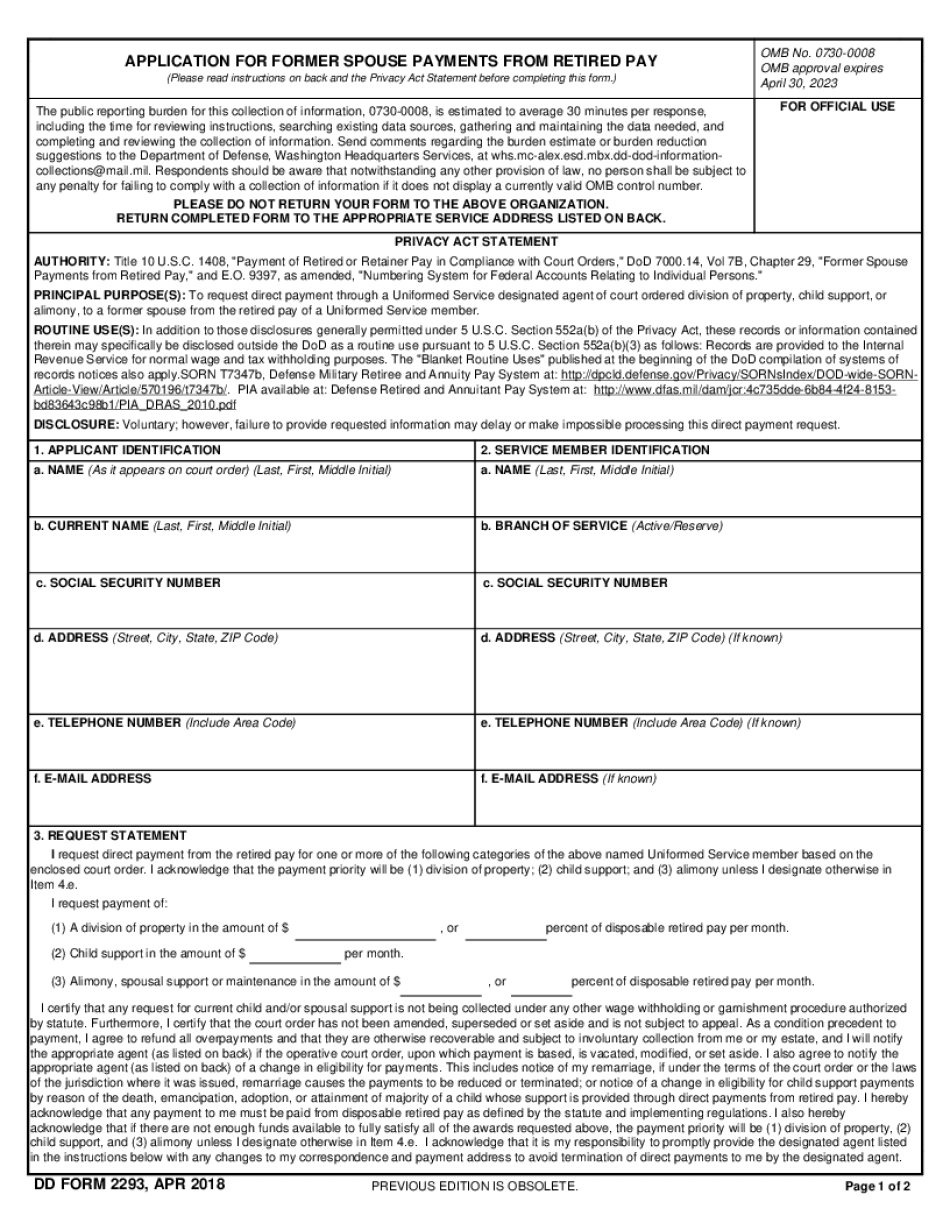

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 2293, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 2293 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 2293 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 2293 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Military retirement divorce adultery