Here is the revised content with the text divided into sentences and mistakes corrected: That is the Uniformed Service Members Former Spouse Protection Act, which authorizes state courts to divide military retirement benefits in a divorce proceeding. The Act caps the recipient spouse's retirement benefits at 50% of disposable earnings. Additionally, the Act provides for the manner in which payment will be made post-divorce. In the event that the marriage is of 10 years or longer, the recipient spouse will receive payment directly from DFS and Cleveland. If the marriage is shorter than 10 years, the recipient spouse will rely upon the service member to remit payment each month. Furthermore, the Act also provides for a cap if there is both an alimony and a child support garnishment in place. In such cases, the garnishment will be capped at 65% of disposable pay.

Award-winning PDF software

Dfas er spouse Form: What You Should Know

Payments received for the benefit of a former spouse under a plan or contract for the operation of a military installation or station are alimony, unless the payment is made in the form of lump sum payment or annuity. Alimony. Alimony is defined as the maintenance of spouses as a permanent arrangement. This means that it is necessary for both parties to meet all other terms of the agreement to reach a mutually acceptable alimony agreement, and is intended to promote marital cooperation, comfort and welfare. The amount of alimony is based on the need of the parties for the maintenance and must be reasonable. The length of maintenance payments is determined from the standard of living available at that time in the marital relationship. The mayor generally determines the duration of alimony at the time the marriage ends. The amount of alimony must be at least as large as the greatest of the following, whichever is greater. Alimony must be: 15,000 per year (a) of the marriage or 1/2 the amount of monthly child support paid by the husband, plus [9,225.00 for each dependent child, ] The amounts must be at least as much as the spouse's normal support obligation, based on the income and expenses of the family. For example, if the husband receives 15,000 a year, the alimony payment to the recipient spouse would be at least 15,000 per year. If, on the other hand, the alimony payments consist of annual payments, then the court may calculate the alimony in accordance with other factors, such as the cost of living in the community, medical and hospital insurance, the spouse's dependents' needs and the amount of time the marriage lasted. If it was necessary for the court to calculate alimony as a percentage of the husband's salary, then the alimony payment would be the salary at the time he retired. b. Periodic payments include payments payable under a court order that is in effect at the time the alimony payments are paid. As such, periodic payments can include payments for alimony, spousal support and child support payments. c. The amount of alimony is considered to be alimony if it is made to a former spouse using a court order. The amount of alimony is considered to be alimony even if the payment is made on a lump sum or annuity basis.

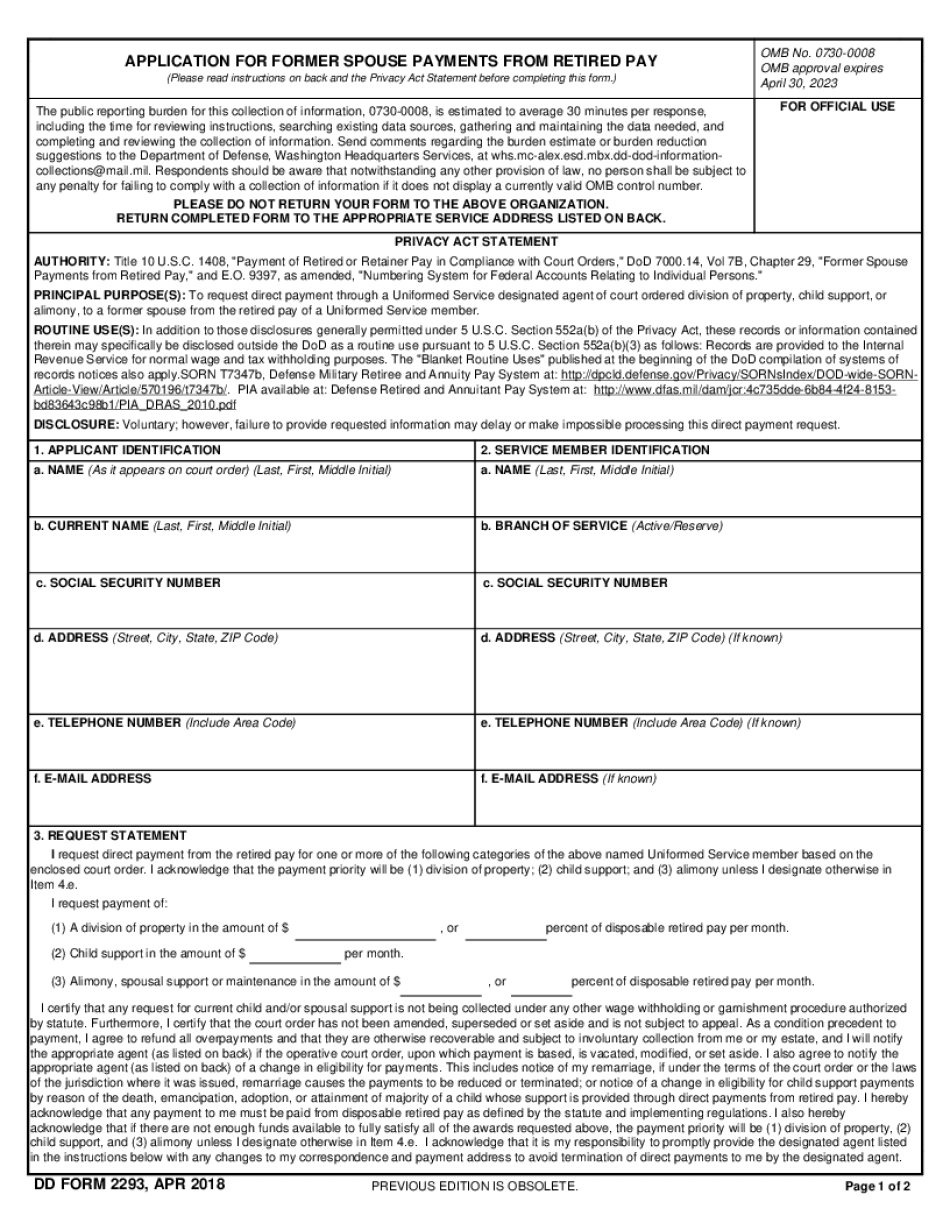

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 2293, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 2293 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 2293 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 2293 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dfas former spouse