In dividing military pensions and benefits, part two covers the formulas for splitting retirement pay for service members recommended by the Uniformed Services Former Spouses Protection Act (USFSPA). In this video, we will discuss the benefits and privileges that you may continue to enjoy even after divorcing a military service member. Let's start with the topic of continuing military benefits. An unmarried former spouse of a military service member is entitled to commissary and Post Exchange (PX) privileges to the same extent as the surviving spouse of a retired member of the uniformed services. This means that if you had commissary and PX privileges at the time of divorce, you can continue to receive these privileges as long as you remain unmarried. The USFSPA uses the 20-20-20 test to determine eligibility for commissary and PX privileges. This means that the service member spouse must have had 20 years of creditable service, the marriage must have lasted 20 years, and there must be a 20-year overlap between the marriage and the creditable service. Now, let's discuss medical benefits. There are three categories of healthcare coverage for former military members. The first is full military health care coverage, which the former spouse can qualify for by remaining unmarried, satisfying the 20-20-20 rule, and not being enrolled in an employer-sponsored health plan. The second category is transitional health care, which provides coverage for up to a year after the divorce. The requirements for this coverage are similar to the requirements for full military health care, except that the former spouse must satisfy the 20-20-15 rule instead of the 20-20-20 rule. To qualify for a second year of coverage, the former spouse must have enrolled in the DoD Continued Health Care Benefit Program. Lastly, there is the DoD Continued Health Care Benefit Program (CHAMPUS), which is available to those losing...

Award-winning PDF software

Military retirement divorce 10/10 rule Form: What You Should Know

Provides that in a divorce case between military retirees and their former spouses, any portion of the retired pay to which the former spouse would be entitled by law is divided among the parties in the following way: the former spouse, as joint property owner, gets 5% of that lump sum; the former spouse, as equal partner, gets 3% of that lump sum. Each spouse and the court must establish how many ex-spouses are entitled to an equal share of the lump sum. The judge must ensure that the percentages are equitable and equal for different ex-spouses so that when the amount of the divorce settlement is divided, each party will receive the same amount of money regardless of who got which ex-spouse's money at settlement. Do I have to pay for my spouse's retirement if we married before September 11, 2001? No, the Military Pay and Retirement Systems Act (MP RSA) (also known as the 10/10 Rule) applies to military retirees regardless of when they were married. All retired pay for veterans and family members of veterans is divided as prescribed by the MP RSA. What is a military retired pay center? A military retired pay center collects the payments for the former spouses of retired service members and the ex-spouses of any former spouses. The former spouses are called “beneficiaries” (but not dependent) and ex-spouses are called “participants.” How do I get my share of the veterans' retirement? You have two options. Option one: You can ask the court in your divorce case to direct the military retirement pay center to divide the retired pay to you automatically as a participant. That means you get a credit that is equal to what you would have been paid had you applied for a military retirement under a standard federal retirement plan. If you get a credit for the other spouse only, you don't get a credit for yourself. The retired pay that the other spouse gets is not affected by this option. How do I get my share of the former spouses' retirement? If you have an ex-spouse who was not a member of the military and who has applied for a separation payment and separation payment benefits under the law, you can also ask the court to order that the former spouses' retirement payments to them are made through a credit of your own. This is called a separation payment or separation payment order. The payments are the credit to you, and they cover both your and the ex-spouse's separation payment.

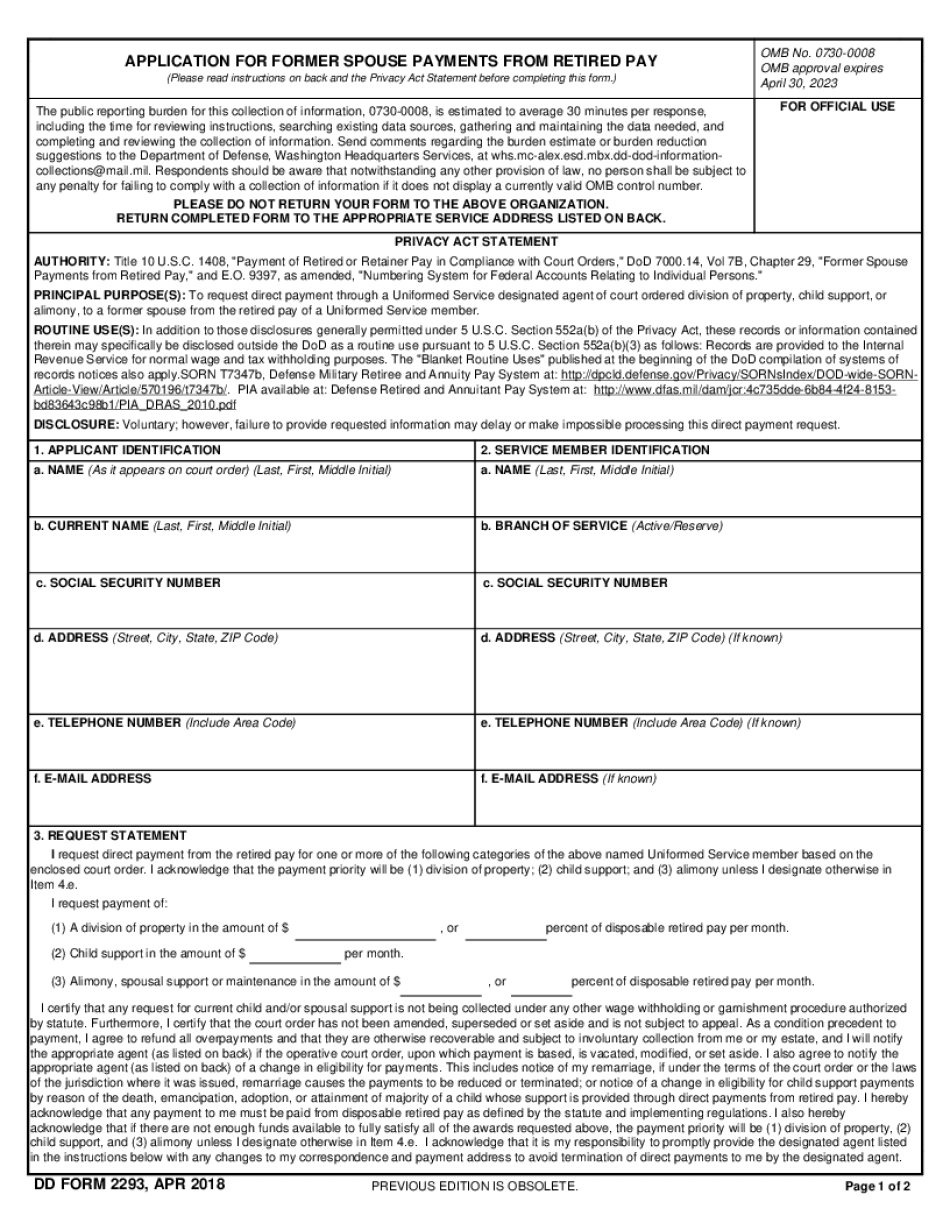

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd 2293, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd 2293 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd 2293 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd 2293 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Military retirement divorce 10/10 rule