Award-winning PDF software

Financial Management Regulation Volume 7B, Chapter 29: What You Should Know

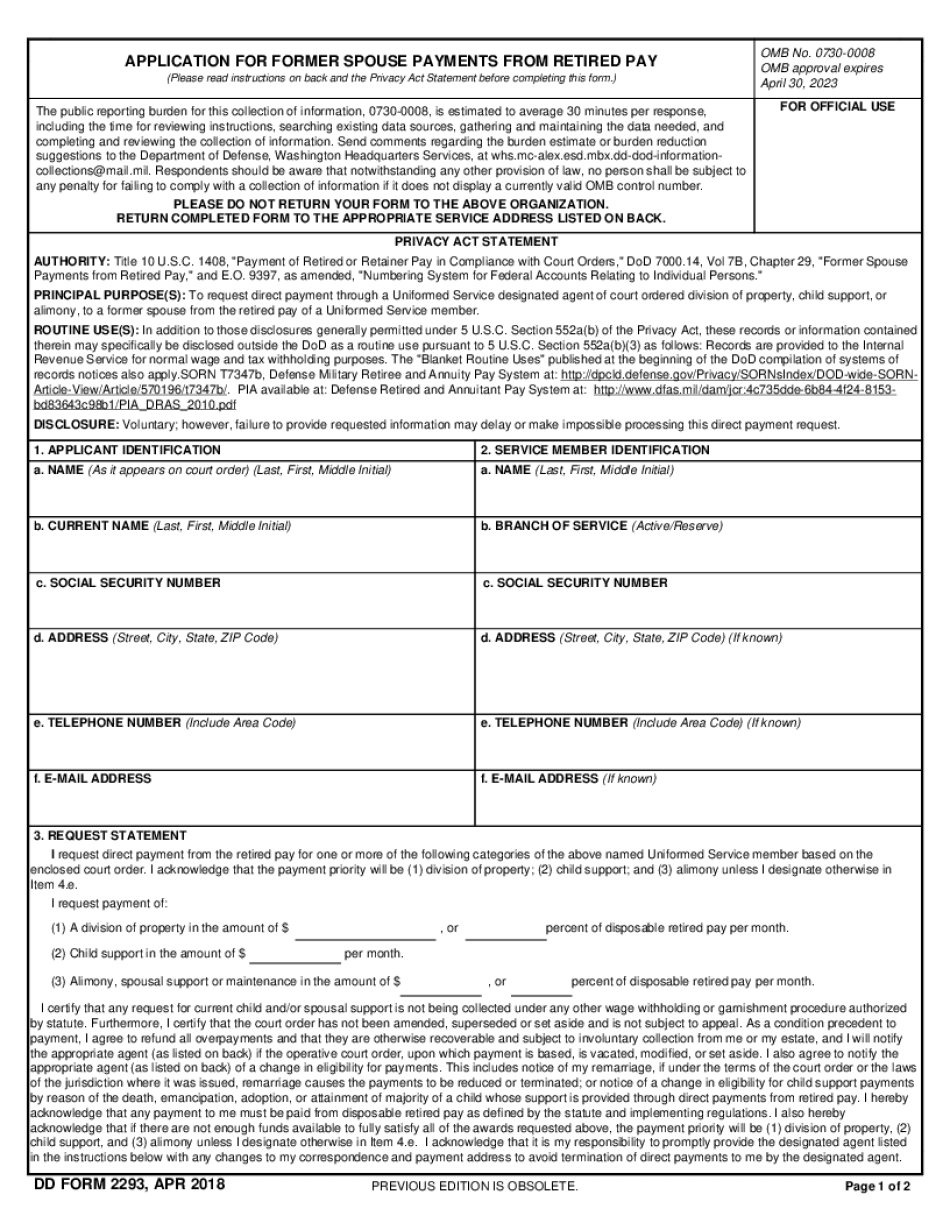

See page 394 for information on how to find information). Table Of Contents. Volumes: 1. Chapter 29: Former Spouses Payment — (Section 5). 2. Chapter 29: Former Spouses Payment — (Section 6A). 3. Chapter 29: Former Spouses Payment — (Section 6B). December 2010. (32 pages, 400 KB) December 2010. 31st Amendment : Chapter 29A. CHAPTER 29A. BACKGROUND— (7 pages, 128 KB). Chapter 29A. January 2010. Chapter 29A; Relevant Time Period; Termination Of Dependencies — November 22, 2009. Dec 19, 2025 — VOLUME 7B, CHAPTER 29: Former Spouse Payments From Retired Pay Chapter 30. CHAPTER 30: SELF-EMPLOYMENT. 1. Introduction. Chapter 30. Chapter 30 — Self-Employment. July 2006. Chapter 30A. September 2009. Chapter 30A; Eligibility Requirements for Dependents — July 28, 2006. Chapter 30A; Eligibility Requirements for Dependents — May 8, 2007. Chapter 30A; Eligibility Requirements for Dependents — April 27, 2008.

Online methods allow you to to organize your document management and improve the productiveness of one's workflow. Abide by the short manual for you to total Financial Management Regulation Volume 7B, Chapter 29, stay clear of problems and furnish it in the timely way:

How to complete a Financial Management Regulation Volume 7B, Chapter 29 on the internet:

- On the website with the sort, simply click Launch Now and go to the editor.

- Use the clues to complete the suitable fields.

- Include your personal info and get in touch with information.

- Make positive that you enter proper knowledge and numbers in acceptable fields.

- Carefully look at the subject material of the sort in addition as grammar and spelling.

- Refer to assist segment should you have any inquiries or tackle our Guidance group.

- Put an electronic signature on the Financial Management Regulation Volume 7B, Chapter 29 together with the assist of Indicator Device.

- Once the form is done, push Carried out.

- Distribute the all set form by means of email or fax, print it out or help you save on the product.

PDF editor allows for you to make variations to the Financial Management Regulation Volume 7B, Chapter 29 from any internet linked gadget, personalize it in accordance with your requirements, indication it electronically and distribute in several means.