Award-winning PDF software

Uniformed Services Former Spouses' Protection Act Dividing Military: What You Should Know

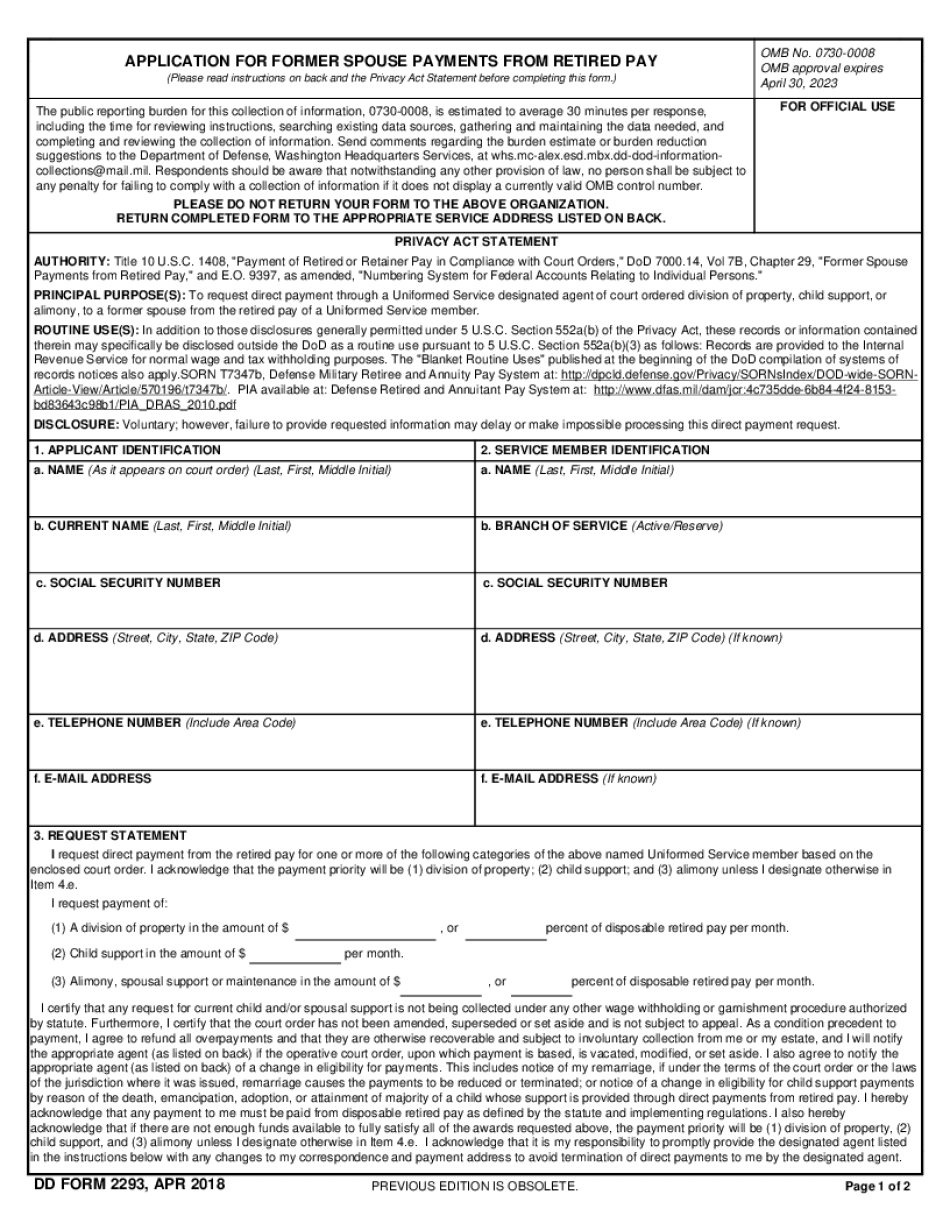

UNIFORMED SERVICES FORMER SPOUSE PROTECTION Act of 2002 to divide military retiree payments amongst the former member and former spouse when required to do so by federal law or court order. Federal Law Prevents State Divisions of Military Retirement Pay Apr 22, 2025 — The USF SPA has been used by 11 states to create some form of property separation or property division for former spouses of military service members. The UNIFORMED SERVICES FORMER SPOUSES PROTECTION Act of 2002 prohibits states from dividing military pay by virtue of the SPA. This law was first passed by Congress and signed into law by President Bill Clinton in 1993. Military Retirement Pay Divided for Former Spouse and Children Oct 3, 2032 — As a result of federal law and state law, members of the armed forces may keep a portion of their military retiree pay. This remains the case unless the state in which the former spouse resides requires different division as federal law and state law dictate. If a state does not require a division, members of the armed forces can keep the full amount of military retiree pay. If the former spouse or children are required to be treated as non-custodial and receive their own share of the pay, there are two sets of laws to make sure that is handled correctly. The Federal Law and State Law If the former spouse is required to be treated as a non-custodial recipient and receive 100% of the pay, a spouse may keep one-half of the Military Retirement Pay The following are specific laws and details. These laws may vary county-to-county: UNIFORMED SERVICES FORMER SPOUSE PROTECTION Act of 2002 A. State law may limit the amount of property the spouse is entitled to receive upon termination of the marriage unless state law provides for a higher amount: State Law: 1. California 2. Montana 3. New Jersey 4. Nevada 5. Ohio 6. Washington 7. Wyoming B. If a non-custodial recipient receives over 80% of the pay for a period of up to three years, then his or her share of the pay must be proportionately reduced within three years, down to 50%: 1.

Online methods enable you to to arrange your document management and boost the productiveness of your workflow. Comply with the quick help as a way to total uniformed services former spouses' protection act dividing military, stay clear of mistakes and furnish it in the well timed manner:

How to complete a uniformed services former spouses' protection act dividing military online:

- On the website with the form, simply click Start out Now and go to the editor.

- Use the clues to complete the applicable fields.

- Include your individual knowledge and make contact with knowledge.

- Make guaranteed that you simply enter right facts and figures in best suited fields.

- Carefully check the content material of your variety likewise as grammar and spelling.

- Refer that will help part if you have any questions or address our Aid crew.

- Put an electronic signature in your uniformed services former spouses' protection act dividing military using the guide of Indication Device.

- Once the form is done, press Finished.

- Distribute the ready form by means of email or fax, print it out or conserve in your product.

PDF editor enables you to definitely make modifications towards your uniformed services former spouses' protection act dividing military from any net linked system, customise it as outlined by your preferences, sign it electronically and distribute in various means.